Business

California Pension Systems Face Rising Debt and Investment Risks

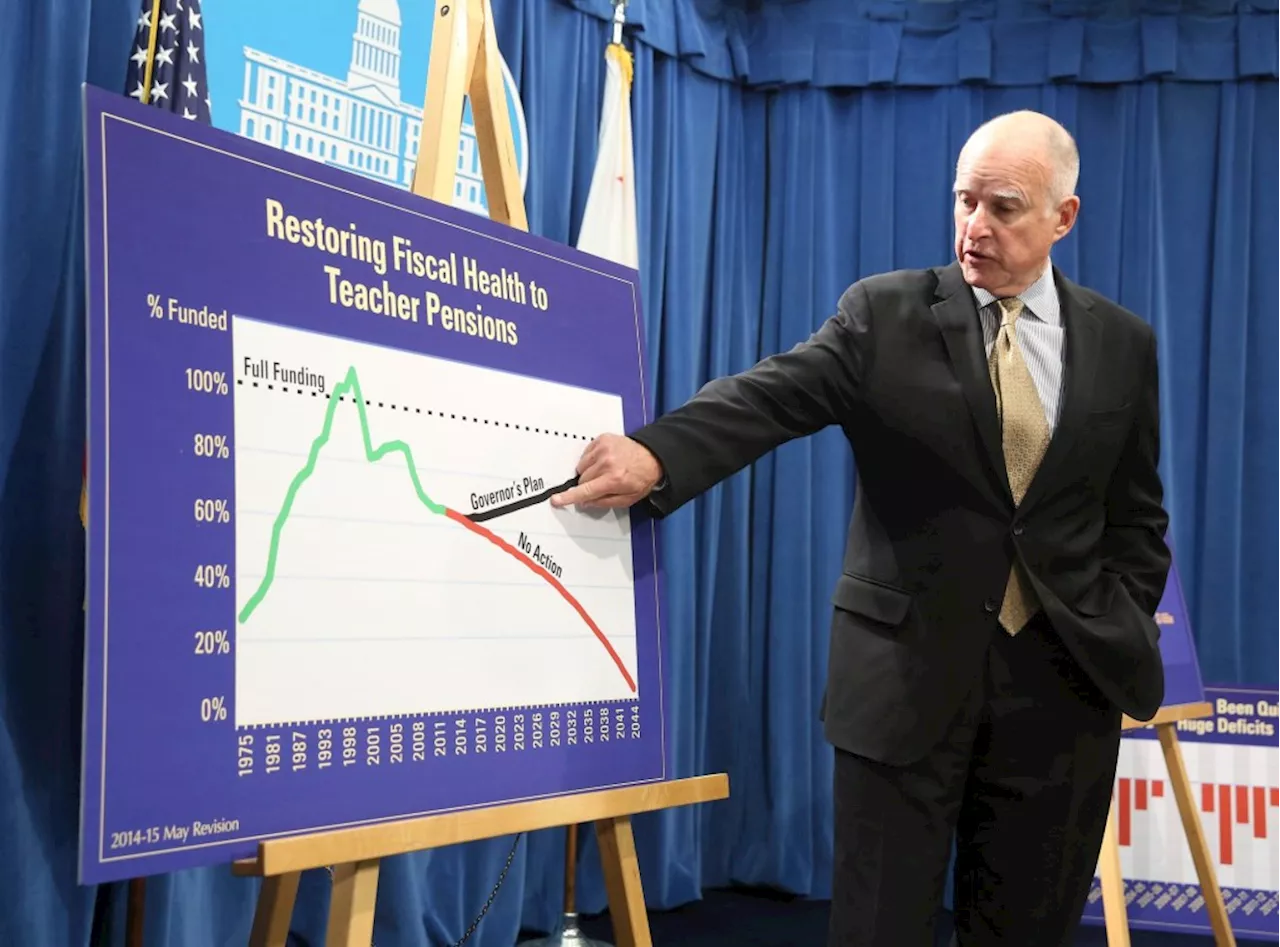

A recent report reveals that California’s public pension systems, namely the California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS), are grappling with escalating debt and increased investment risks. These challenges could impose a significant financial burden on taxpayers, as the state and local governments face total unfunded pension liabilities exceeding $265 billion.

The analysis by the Reason Foundation highlights that CalPERS, managing $558 billion in assets, and CalSTRS, with $382 billion, are taking on higher risks than many other pension systems while yielding comparatively low investment returns. This situation places California at the forefront of public pension debt in the United States, with each resident bearing more than $6,000 in pension debt.

For context, CalPERS stands at approximately $166 billion in debt, while CalSTRS reports $39 billion in unfunded liabilities. As pension benefits are constitutionally protected, the responsibility for this debt falls on the taxpayers. With rising costs, the burden of repaying pension obligations is expected to consume an increasing share of state and local budgets in the coming years.

Many public pension plans, including California’s, are shifting toward riskier investment strategies in a bid to enhance returns. Historically reliant on stocks and bonds, these funds are now allocating greater portions of their assets to alternative investments such as real estate, hedge funds, and private equity. This transition raises concerns as these strategies often come with less transparency and more volatility, potentially leading to substantial losses that taxpayers would ultimately bear.

The share of California’s pension assets in alternative investments has surged from 11% in 2001 to 37% in 2024, ranking 18th in the nation. CalPERS has notably increased its exposure to private equity over the past four years, aiming for these assets to comprise 40% of its portfolio.

Efforts to compensate for past shortfalls in funding retirement benefits have prompted CalPERS to seek higher returns through riskier avenues, despite the accompanying high fees and opaque accounting practices that primarily benefit fund managers rather than retirees. The financial strain on taxpayers may intensify if these alternative investments do not deliver the promised returns.

Investment performance has been a pressing issue, with both CalPERS and CalSTRS struggling to keep pace with other public pension systems nationwide. Over the past two decades, CalPERS achieved an average return of 6.8%, while CalSTRS reported 7.6%. In contrast, the S&P 500 index averaged 10.4% during the same period. Even in the last five years, California’s pension systems ranked 36th out of 50 states in average investment returns, with a rate of 7.51% compared to Nevada’s 9.67% and Washington’s 9.66%.

As California’s pension systems navigate these financial challenges, the focus must remain on achieving sustainable investment returns while carefully evaluating the risks involved. Taxpayers should be assured that their money and the retirement benefits of public workers are being managed prudently, avoiding excessive risk that could lead to further financial burdens on state and local budgets.

In summary, California’s public pension systems face critical decisions that will impact future funding and fiscal responsibility. With the current trajectory, it is imperative for CalPERS, CalSTRS, and other public pension plans to adopt a cautious approach to investment strategies to safeguard taxpayer interests and ensure the stability of retirement benefits for government workers.

-

Top Stories2 months ago

Top Stories2 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World2 months ago

World2 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

World2 months ago

World2 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

World2 months ago

World2 months agoElectrification Challenges Demand Advanced Multiphysics Modeling

-

Business2 months ago

Business2 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Science2 months ago

Science2 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Top Stories2 months ago

Top Stories2 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Entertainment2 months ago

Entertainment2 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Business2 months ago

Business2 months agoUS Government Denies Coal Lease Bid, Impacting Industry Revival Efforts

-

Health2 months ago

Health2 months agoGavin Newsom Critiques Trump’s Health and National Guard Plans

-

Politics1 month ago

Politics1 month agoSEVENTEEN’s Mingyu Faces Backlash Over Alcohol Incident at Concert