Health

Alaska Small Businesses Brace for Healthcare Cost Surge

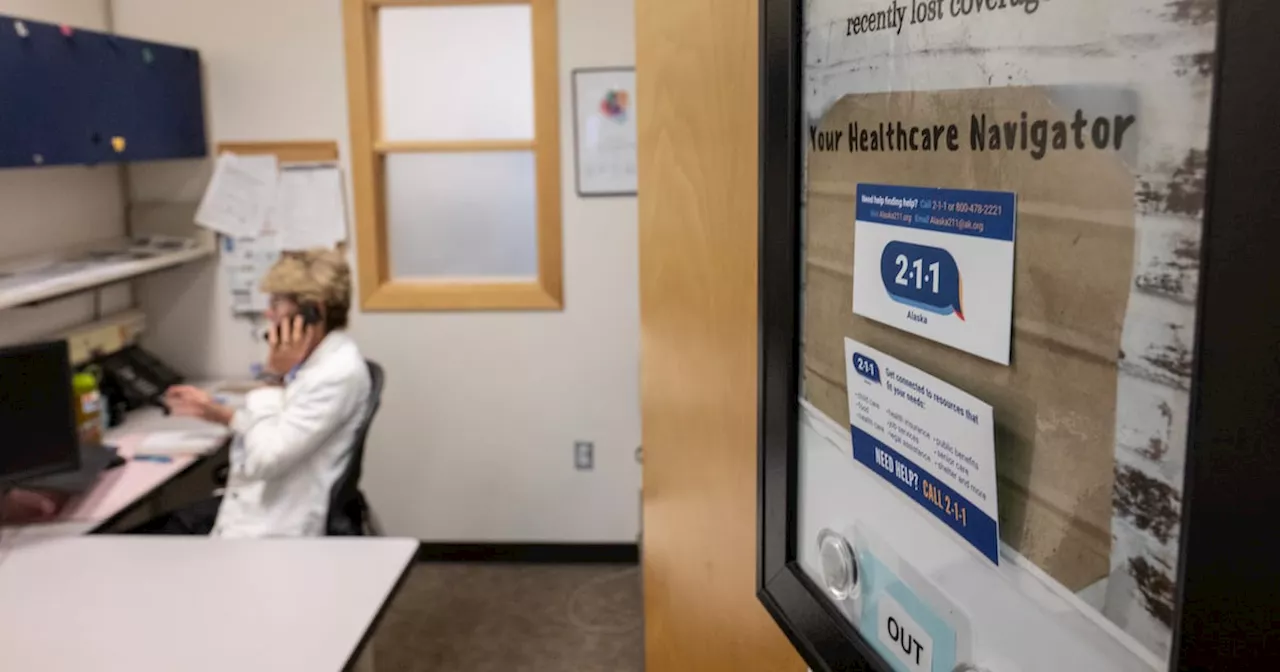

The impending expiration of health care subsidies at the end of 2025 poses a significant threat to small-business owners across Alaska, many of whom face the prospect of insurance premiums tripling. With enhanced premium tax credits from the Affordable Care Act set to lapse, thousands may see their monthly costs soar, jeopardizing the financial stability of their operations.

The situation has raised alarms among local entrepreneurs. For instance, Brie Loidolt, who runs a bookkeeping business in Anchorage, anticipates her premiums increasing by hundreds of dollars each month. “We’re working tooth and nail every day to make our way so we don’t have to rely on any help and assistance,” Loidolt stated. She is among many business owners who feel that Congress is “punishing us for being small-business owners,” as the financial burden of healthcare becomes increasingly unmanageable.

Alaska’s U.S. Senator Lisa Murkowski has expressed support for extending the tax credits, emphasizing the need for a short-term solution to prevent drastic price increases. Similarly, Senator Dan Sullivan has voiced his backing for the continuation of the subsidies. In contrast, U.S. Representative Nick Begich has yet to comment on the issue despite repeated requests.

The urgency for legislative action is palpable, particularly with the deadline approaching. According to reports, Congress must act before the end of the year to avert the projected rise in costs. The recent conclusion of the longest government shutdown in U.S. history did not yield any agreement on extending these critical subsidies, leaving many Alaskans anxious about their healthcare options for 2026.

Mark Robokoff, who owns a pet supply shop in Anchorage, is one such business owner facing the reality of a more than 300% increase in his insurance premium, which is projected to jump from $924 to $2,886 monthly. “This will pull the rug out from under me,” Robokoff remarked. His business, he believes, contributes positively to the local economy by creating jobs and enhancing community life.

The impact of losing the tax credits will vary depending on factors such as income level, age, and family size. Notably, those nearing retirement age with incomes at or above 401% of the poverty line will feel the most significant squeeze. Among the approximately 25,000 Alaskans enrolled in Affordable Care Act plans, many are small-business owners grappling with potential financial ruin.

Loidolt has already calculated that without the subsidies, her insurance premiums will exceed her mortgage payments, costing her an additional $6,000 annually. She currently pays $1,347 per month for her insurance. “Who can afford to live when 30% of everything you bring in just pays for insurance and deductible?” she questioned.

Moreover, she has encountered hurdles in securing a company plan for her business due to insurance companies’ reluctance to offer plans to firms with fewer than five employees. This limited choice leaves her feeling trapped.

Her recent accident has added to her medical needs, making it imperative that she maintains her coverage. Yet, the rising costs have led her to consider drastic measures, including shutting down her business and laying off her employees, which she describes as “heartbreaking.”

Another local entrepreneur, Nan Schleusner, has also expressed concern. She and her husband have relied on the Affordable Care Act since the enhanced tax credits became available. The subsidies allowed them to manage their healthcare costs better, particularly as they have faced increasing medical expenses. “It was really wonderful when the enhanced premium tax credits took effect,” she shared.

Currently, Schleusner is confronted with a staggering annual premium of $37,000 and a deductible of $15,000 for the cheapest plan available. She is contemplating joining the insurance plan of one of her consulting clients to alleviate the financial strain. “There’s the affordability part, but there’s the ‘what on Earth is going on that this is costing $50,000 a year?’ That’s not a reasonable cost,” she remarked.

As the deadline for congressional action looms, small-business owners across Alaska are left grappling with the implications of potential policy changes. With their livelihoods hanging in the balance, many are calling for urgent intervention from their congressional representatives to ensure that the necessary support is provided. The lives and businesses of countless Alaskans may depend on it.

-

Top Stories1 month ago

Top Stories1 month agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World1 month ago

World1 month agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

World1 month ago

World1 month agoMass Production of F-35 Fighter Jet Drives Down Costs

-

World1 month ago

World1 month agoElectrification Challenges Demand Advanced Multiphysics Modeling

-

Science1 month ago

Science1 month agoTime Crystals Revolutionize Quantum Computing Potential

-

Business1 month ago

Business1 month agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Entertainment1 month ago

Entertainment1 month agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Top Stories1 month ago

Top Stories1 month agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Lifestyle1 month ago

Lifestyle1 month agoDiscover Reese Witherspoon’s Chic Dining Room Style for Under $25

-

Health1 month ago

Health1 month agoGavin Newsom Critiques Trump’s Health and National Guard Plans

-

Lifestyle1 month ago

Lifestyle1 month agoLia Thomas Honored with ‘Voice of Inspiration’ Award at Dodgers Event

-

Business1 month ago

Business1 month agoUS Government Denies Coal Lease Bid, Impacting Industry Revival Efforts