Top Stories

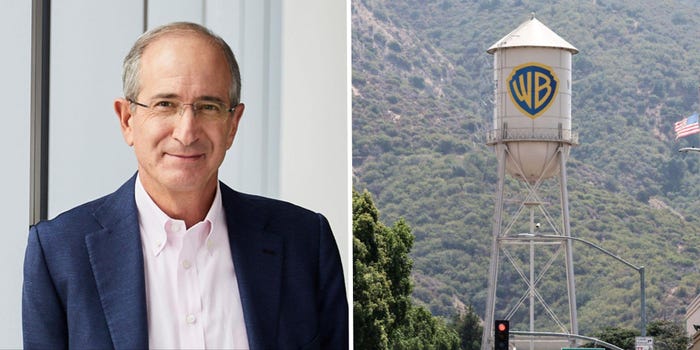

Comcast Eyes Warner Bros. Discovery in Urgent Bidding War

URGENT UPDATE: A fierce bidding war for Warner Bros. Discovery (WBD) is heating up, with Comcast, Paramount, and Netflix all vying for the media giant’s valuable assets. Analysts suggest that Comcast’s co-CEO Brian Roberts may be the most driven bidder, presenting a potential game-changer for the company’s streaming ambitions.

The stakes could not be higher as the competition intensifies. Industry insiders believe that acquiring WBD’s movie studio and streaming platform could be a “once-in-a-generation opportunity” for Comcast to revamp its image and offerings, according to Rich Greenfield, media analyst at LightShed Partners. With HBO Max and its expansive library, this acquisition could enable Comcast to significantly enhance its Peacock streaming service, which has stagnated at 41 million subscribers for three consecutive quarters.

As of late October 2023, reports indicate that Paramount’s David Ellison appeared to hold an advantage in the bidding due to his wealth and connections, including a notable relationship with former President Donald Trump. However, analysts believe that despite the financial muscle of both Paramount and Netflix, Comcast may have the most to gain from integrating WBD into its portfolio.

Brandon Katz from Greenlight Analytics noted, “It’s clear that NBCUniversal has the most to gain in raw streaming upside from a WBD acquisition.” The integration of Warner Bros. Studios and HBO could transform Comcast into a formidable competitor against entertainment giants like Disney.

Both Comcast and Paramount would gain significantly from an alliance with HBO Max. However, Peacock has the most at stake, as its current subscriber base is limited to the United States. Meanwhile, Paramount+ has shown impressive growth, now boasting 79.1 million subscribers globally.

Experts, including veteran media analyst Craig Moffett, argue that HBO Max is “the most obvious partner” for Peacock, given the minimal overlap in their user bases. Approximately 40% of HBO Max users also subscribe to Paramount+, while only 20% overlap with Peacock. This limited overlap could create a lucrative bundling opportunity that would enhance revenue streams for Comcast.

Comcast’s strategy also includes substantial investments in sports media rights, indicating a serious commitment to expanding its streaming foothold. Katz emphasized, “The massive outlay for sports rights alone doesn’t make sense for US-only distribution,” hinting at broader ambitions for Comcast beyond its current offerings.

However, challenges loom for Comcast. Its current price-to-earnings ratio is the lowest among S&P 500 companies, presenting potential roadblocks for funding a substantial acquisition. Additionally, regulatory hurdles could slow down or derail a potential deal, especially given Trump’s criticisms of Comcast in the past. Moffett warned that the current administration might raise antitrust concerns regarding the merger.

Nevertheless, analysts like Greenfield remain optimistic, suggesting that Comcast could navigate these challenges by finding common ground with key stakeholders. Losing out on WBD could leave Peacock “stranded without an obvious merger partner,” creating a pressing need for Comcast to act decisively.

As the bidding war unfolds, Comcast’s moves will be closely watched. If they pursue WBD aggressively, they may disrupt Ellison’s plans and reshape the competitive landscape of the media industry. The outcome of this high-stakes battle could redefine streaming dynamics and impact millions of viewers worldwide.

Stay tuned for the latest developments as this story unfolds.

-

Top Stories2 months ago

Top Stories2 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World2 months ago

World2 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

World2 months ago

World2 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

World2 months ago

World2 months agoElectrification Challenges Demand Advanced Multiphysics Modeling

-

Business2 months ago

Business2 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Science2 months ago

Science2 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Top Stories2 months ago

Top Stories2 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Entertainment2 months ago

Entertainment2 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Business2 months ago

Business2 months agoUS Government Denies Coal Lease Bid, Impacting Industry Revival Efforts

-

Health2 months ago

Health2 months agoGavin Newsom Critiques Trump’s Health and National Guard Plans

-

Lifestyle2 months ago

Lifestyle2 months agoDiscover Reese Witherspoon’s Chic Dining Room Style for Under $25