Top Stories

Nvidia’s Blockbuster Earnings Ignite Tech Stock Surge NOW

UPDATE: Nvidia has just reported a phenomenal third-quarter earnings surge, injecting fresh confidence into the tech sector and sending stocks soaring. The chipmaker’s results have reinvigorated the beleaguered AI trade, as investors react positively to its promising guidance.

In a shocking announcement, Nvidia revealed $57 billion in revenue for the quarter, a stunning 62% increase year-over-year. The company is now projecting $65 billion in revenue for the upcoming quarter, surpassing analysts’ expectations of $61 billion. Shares of Nvidia jumped 5%, leading a broader tech rally that saw the Nasdaq index rise more than 2%.

Tech stocks across the board are experiencing dramatic gains, with notable movers including:

– Super Micro Computer: +6.4%

– Advanced Micro Devices: +4.6%

– Broadcom: +3.3%

– Taiwan Semiconductor Manufacturing: +2.7%

– Intel: +2.1%

Major U.S. indexes opened strong on Thursday morning, with the S&P 500 at 6,742.50 (up 1.5%), the Dow Jones Industrial Average at 46,637.69 (up 1.13% or 521 points), and the Nasdaq Composite at 23,037.78 (up 2%).

Analysts had been cautious in recent weeks amid fears of an AI bubble and high valuations. However, Nvidia’s robust performance has assuaged many concerns about the sustainability of demand for AI chips.

“It has been many decades since one stock could move the market like Nvidia,”

said David Rosenberg, president of Rosenberg Research. His comments reflect the monumental impact Nvidia’s results have had on the market.

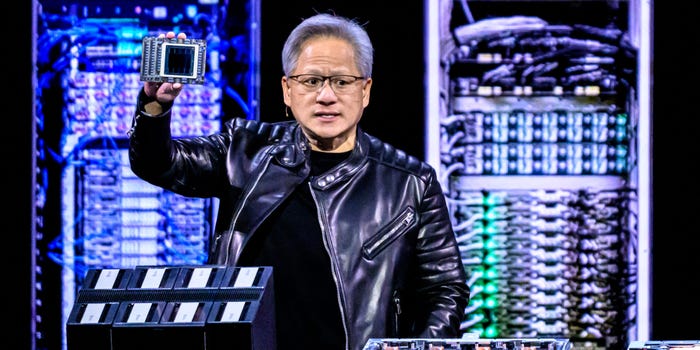

Jensen Huang, Nvidia’s CEO, is being hailed as a pivotal figure in the AI revolution. Dan Ives, analyst at Wedbush Securities, stated,

“There is one company in the world that is the foundation for the AI Revolution, and that is Nvidia.”

Huang’s insights during the earnings call provided the reassurance that tech investors desperately needed.

Despite this optimism, caution remains. Analysts continue to voice concerns about potential overvaluation. Rosenberg warned,

“This remains a bubble of epic proportions,”

suggesting that the anticipated growth in the AI market could be overly optimistic.

With Nvidia’s earnings catalyzing a significant market rebound, all eyes are now on how this momentum will affect future tech investments. Investors are urged to watch closely as the implications of these developments unfold in real time.

As the tech landscape shifts dramatically, Nvidia’s role as a bellwether for AI and technology stocks remains pivotal. The urgency of the moment is clear—stay tuned for further updates as this story develops.

-

Top Stories2 months ago

Top Stories2 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World2 months ago

World2 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

World2 months ago

World2 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

World2 months ago

World2 months agoElectrification Challenges Demand Advanced Multiphysics Modeling

-

Business2 months ago

Business2 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Science2 months ago

Science2 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Top Stories2 months ago

Top Stories2 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Entertainment2 months ago

Entertainment2 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Business2 months ago

Business2 months agoUS Government Denies Coal Lease Bid, Impacting Industry Revival Efforts

-

Health2 months ago

Health2 months agoGavin Newsom Critiques Trump’s Health and National Guard Plans

-

Lifestyle2 months ago

Lifestyle2 months agoDiscover Reese Witherspoon’s Chic Dining Room Style for Under $25