Top Stories

Urgent FX Options Expiry Set to Impact EUR/USD and USD/JPY Today

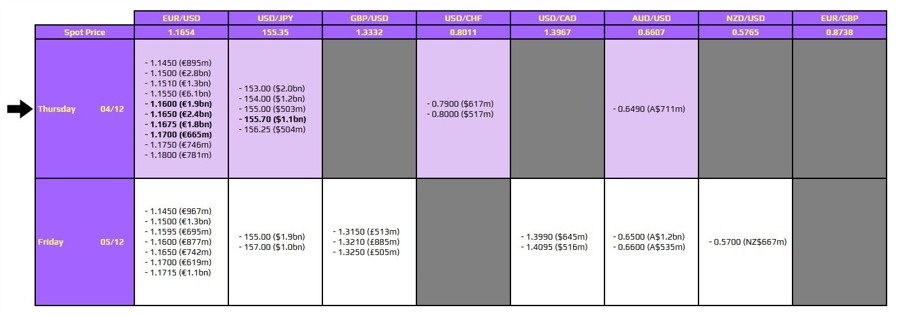

UPDATE: Significant FX options expiries are set for December 4 at 10 AM EST, with crucial implications for currency traders. The focus is on the EUR/USD pair, where options are layered from 1.1600 to 1.1700, particularly concentrated around the 1.1650 level. This development is likely to restrict price movements in today’s session.

The presence of these large expiries could keep EUR/USD trading within a narrow range, especially with the dollar showing weakness this week. Traders should brace for limited volatility as these expiries approach, which could roll off later today.

In addition, the USD/JPY pair faces a key expiry at 155.70, closely aligned with the 100-hour moving average of 155.67. This alignment may further cap any upward movement for the pair. The USD/JPY continues to feel pressure amid a softer dollar and growing expectations of a potential Bank of Japan rate hike this month.

Market analysts emphasize the importance of these expiries as they could significantly influence trading dynamics in the short term. With EUR/USD and USD/JPY under scrutiny, traders should stay alert for shifts in market sentiment as the expiry time approaches.

For a comprehensive understanding of how to interpret these FX options data, traders can visit investingLive (formerly ForexLive) for expert insights.

Stay tuned for further updates as this situation develops.

-

Science3 weeks ago

Science3 weeks agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

Top Stories2 months ago

Top Stories2 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World2 months ago

World2 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

World2 months ago

World2 months agoElectrification Challenges Demand Advanced Multiphysics Modeling

-

World2 months ago

World2 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

Science2 months ago

Science2 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Business2 months ago

Business2 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Politics1 month ago

Politics1 month agoSEVENTEEN’s Mingyu Faces Backlash Over Alcohol Incident at Concert

-

Top Stories2 months ago

Top Stories2 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Entertainment2 months ago

Entertainment2 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Business2 months ago

Business2 months agoUS Government Denies Coal Lease Bid, Impacting Industry Revival Efforts

-

Health2 months ago

Health2 months agoGavin Newsom Critiques Trump’s Health and National Guard Plans