Top Stories

Trump’s Meeting with Xi Fuels Market Rebound After Slump

UPDATE: In a significant shift, European markets are rebounding this morning following a heavy slump, driven by US President Donald Trump‘s announcement of a meeting with Chinese President Xi Jinping in just two weeks. This development comes after a tense period marked by escalating US-China trade tensions and a prior selloff in stock markets.

Throughout the early morning trade, a cautious risk sentiment dominated as traders absorbed the impact of yesterday’s downturn, where S&P 500 futures fell by as much as 1.3%. However, following Trump’s comments, futures have trimmed losses significantly, now down only 0.3%. Trump’s remarks during a Fox Business interview, where he expressed optimism saying, “we’ll be fine with China,” and labeled high tariffs as “unsustainable,” have injected new life into risk assets ahead of US trading hours.

In the currency markets, the US dollar is recovering from earlier losses. The USD/JPY pair climbed back above 150.00 after dipping to 149.40, now sitting 0.2% down on the day. The EUR/USD is trading flat at 1.1690, while the GBP/USD remains stable at 1.3437. The Australian dollar also cut losses, rising from 0.6450 to 0.6485.

Despite the positive shift in sentiment from the US, European stocks are still feeling the weight of yesterday’s decline. The DAX index is currently down over 1.6%, while France’s CAC 40 has managed to pare losses to just 0.2%. Investors are grappling with the aftereffects of Wall Street’s downturn, making the rebound more challenging.

In the commodities market, gold experienced a fluctuating session, initially spiking to $4,370 before retreating to $4,292, reflecting a decrease of 0.8%. Profit-taking and a recovering risk mood contributed to this decline, diminishing gold’s earlier gains.

Cryptocurrency markets are also in focus today as Bitcoin slumps to fresh four-month lows, briefly falling below $104,000. This decline poses technical risks as Bitcoin threatens to drop below both its 200-day moving average for the first time since April, raising alarms among investors ahead of the weekend.

As markets brace for the upcoming meeting between Trump and Xi, traders are keenly watching for further developments that could impact the risk landscape. The next few hours will be critical as US trading gets underway, determining whether this morning’s optimism will hold or fade away. Stay tuned for live updates as this story unfolds.

-

Science3 months ago

Science3 months agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

Science3 months ago

Science3 months agoDoctoral Candidate Trivanni Yadav Advances Battery Research at UTulsa

-

World4 months ago

World4 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

Top Stories4 months ago

Top Stories4 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World4 months ago

World4 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

Sports3 months ago

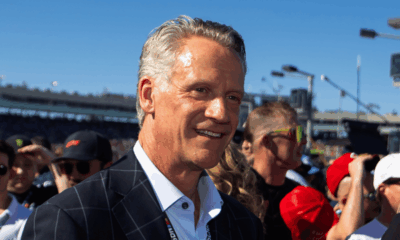

Sports3 months agoNASCAR Faces Fan Backlash as Steve Phelps’ Texts Surface

-

Business4 months ago

Business4 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Top Stories4 months ago

Top Stories4 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Politics4 months ago

Politics4 months agoSEVENTEEN’s Mingyu Faces Backlash Over Alcohol Incident at Concert

-

Science4 months ago

Science4 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Entertainment4 months ago

Entertainment4 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Science4 months ago

Science4 months agoRemembering David E. Brest: A Life Dedicated to Nature and Family