Business

FDVV’s 2.78% Yield Underperforms Compared to SCHD’s 3.80%

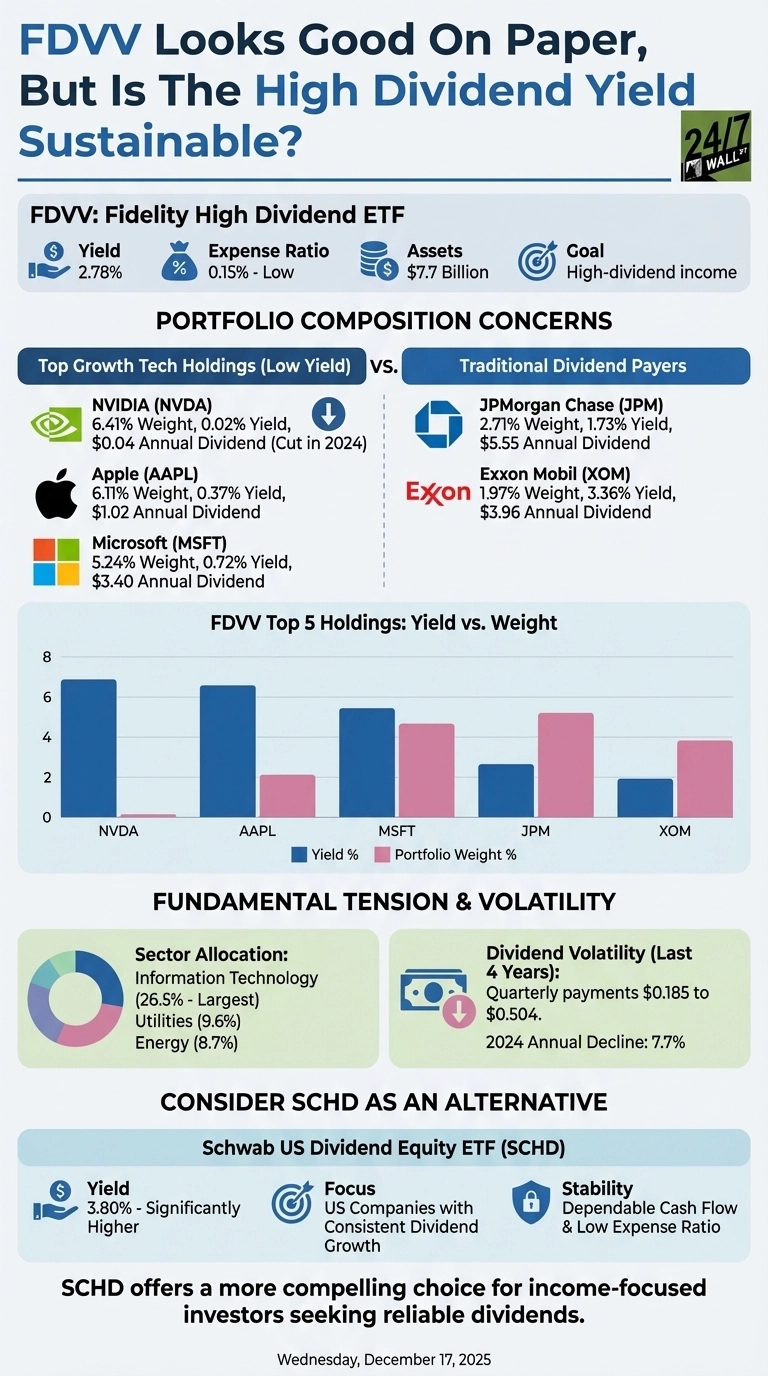

The Fidelity High Dividend ETF (NYSEARCA:FDVV) is facing scrutiny as its yield of 2.78% pales in comparison to the 3.80% yield offered by the Schwab US Dividend Equity ETF (NYSEARCA:SCHD). This disparity raises concerns for income-focused investors, particularly retirees who depend on steady cash flow from their investments.

FDVV, which manages approximately $7.7 billion in assets with a low 0.15% expense ratio, aims to track the Fidelity High Dividend Index of large and mid-cap stocks. However, an analysis of its portfolio reveals a troubling reliance on high-growth technology stocks that generate minimal dividend income.

Concerns Surrounding Portfolio Composition

The top three holdings in FDVV—NVIDIA, Apple, and Microsoft—together make up nearly 18% of the fund but collectively yield less than 0.5%. NVIDIA (NASDAQ:NVDA), which constitutes 6.41% of the portfolio, has a yield of just 0.02%, with an annual dividend of $0.04 per share. This year, NVIDIA significantly reduced its quarterly dividend from $0.04 to $0.01, a 75% cut that indicates a strategic shift towards reinvestment rather than returning value to shareholders.

Meanwhile, Apple (NASDAQ:AAPL) holds 6.11% of the fund and offers a yield of 0.37%, translating to an annual dividend of $1.02. Microsoft (NASDAQ:MSFT) comprises 5.24% of FDVV, providing a yield of 0.72% with an annual dividend of $3.40. While these companies are leaders in their fields, their limited dividend payouts are a concern for investors seeking reliable income.

In contrast, more traditional dividend-paying stocks offer greater stability. For instance, JPMorgan Chase (NYSE:JPM), which accounts for 2.71% of the portfolio, provides a yield of 1.73% with an annual dividend of $5.55. Exxon Mobil (NYSE:XOM), at 1.97% of holdings, offers a yield of 3.36% with an annual dividend of $3.96. However, the energy sector has faced challenges, with recent quarterly earnings declining 8% year-over-year due to energy price fluctuations.

The current allocation of 26.5% to information technology within FDVV undermines its objective of providing consistent dividend income. Sectors traditionally associated with stable payouts, such as utilities and energy, are significantly underweighted at 9.6% and 8.7%, respectively. This distribution strategy has led to notable volatility in dividend payments, which have fluctuated from $0.185 to $0.504 quarterly over the past four years. After a cumulative dividend growth of 48% from 2020 to 2023, FDVV has now experienced its first annual dividend decline, dropping 7.7% in 2024.

SCHD as a Viable Alternative for Income Investors

For income-driven investors, the Schwab US Dividend Equity ETF (SCHD) stands out as a more reliable option. With a yield of 3.80%, SCHD provides a significantly higher income stream compared to FDVV. This fund is designed to invest exclusively in U.S. companies with a proven track record of consistent dividend growth.

SCHD employs rigorous screening criteria that emphasizes financial strength and dividend sustainability, resulting in a portfolio that leans towards traditional dividend-paying sectors rather than high-growth technology. The fund has consistently demonstrated stable quarterly distributions and maintains a comparable low expense ratio, making it an attractive choice for those prioritizing dependable cash flow.

As investors often focus on selecting individual stocks and funds, they frequently overlook the crucial aspect of creating a reliable retirement income stream. The transition from wealth accumulation to drawing income from investments poses significant challenges, particularly for individuals in their 50s, 60s, and 70s.

To address this issue, resources such as The Definitive Guide to Retirement Income provide essential strategies and straightforward mathematics for converting investments into a sustainable income source. This guide is currently available for free, underscoring the importance of planning for a secure financial future in retirement.

In summary, while FDVV markets itself as a high-dividend ETF, its low yield and reliance on low-paying growth stocks may not serve the needs of income-focused investors, especially when compared to the more stable income offered by SCHD.

-

Science1 month ago

Science1 month agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

Politics2 months ago

Politics2 months agoSEVENTEEN’s Mingyu Faces Backlash Over Alcohol Incident at Concert

-

Top Stories2 months ago

Top Stories2 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World2 months ago

World2 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

World2 months ago

World2 months agoElectrification Challenges Demand Advanced Multiphysics Modeling

-

World2 months ago

World2 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

Business2 months ago

Business2 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Science2 months ago

Science2 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Top Stories2 months ago

Top Stories2 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Entertainment2 months ago

Entertainment2 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Business2 months ago

Business2 months agoUS Government Denies Coal Lease Bid, Impacting Industry Revival Efforts

-

Health2 months ago

Health2 months agoGavin Newsom Critiques Trump’s Health and National Guard Plans