Top Stories

Stocks Surge to Record Highs as Inflation Data Signals Fed Cuts

BREAKING: Stocks are surging to record highs this morning as new inflation data fuels expectations of continued interest rate cuts by the Federal Reserve. The September inflation rate was reported at 3%, slightly below economists’ forecasts, prompting a wave of investor optimism on October 17, 2025.

Following this announcement, major stock market indexes soared right after the 9:30 a.m. opening bell. The S&P 500 surged to 6,792.33, up 0.8%; the Dow Jones Industrial Average increased to 46,734.61, showing a gain of 0.7% or 328.16 points; and the Nasdaq Composite climbed to 23,198.70, up 1.14%.

This inflation data marks the first significant economic indicator released since the government shutdown on October 1, and it eases fears over potential tariff impacts on consumer prices. According to the Bureau of Labor Statistics, the current inflation level indicates that tariff pressures are less severe than previously predicted.

“As odd as it may seem, the Fed will be happy with inflation staying around 3% for the next couple of months,”

stated Olu Sonola, head of US economic research at Fitch Ratings. He emphasized that the muted tariff passthrough points to a shifting focus towards a weakening labor market, which is crucial for investors to consider.

Despite the absence of a jobs report for September, various indicators suggest a cooling labor market. Reports from sources like ADP indicate that payroll growth is slowing and layoffs are rising across US companies.

Chris Zaccarelli, chief investment officer at Northlight Asset Management, commented on the economic climate, saying, “The latest data suggests that the bull market can continue for now. We understand that valuations are high and there are risks in the market, but with the Fed cutting rates—and this report does nothing to stop them from a 25-bps cut next week—it’s hard to see an interruption of this year’s bull market.”

Zaccarelli noted that while challenges may arise next year, the upward trend is likely to persist through the end of this year, encouraging investors to stay engaged in the market.

This developing situation is critical for both individual and institutional investors as they navigate a landscape shaped by economic indicators and Federal Reserve policies. Stay tuned for more updates as this story unfolds.

-

Science3 months ago

Science3 months agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

Science3 months ago

Science3 months agoDoctoral Candidate Trivanni Yadav Advances Battery Research at UTulsa

-

World4 months ago

World4 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

Top Stories4 months ago

Top Stories4 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World4 months ago

World4 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

Sports3 months ago

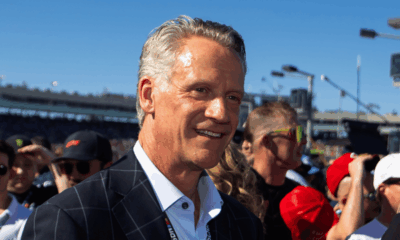

Sports3 months agoNASCAR Faces Fan Backlash as Steve Phelps’ Texts Surface

-

Business4 months ago

Business4 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Top Stories4 months ago

Top Stories4 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Politics4 months ago

Politics4 months agoSEVENTEEN’s Mingyu Faces Backlash Over Alcohol Incident at Concert

-

Science4 months ago

Science4 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Entertainment4 months ago

Entertainment4 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Science4 months ago

Science4 months agoRemembering David E. Brest: A Life Dedicated to Nature and Family