Business

Burberry Group and Zumiez: A Comprehensive Investment Comparison

Investors are weighing the merits of two prominent retail companies, Burberry Group and Zumiez, as they consider potential investment opportunities. This analysis will compare the two firms based on valuation, analyst recommendations, profitability, dividends, risk, and institutional ownership.

Earnings and Financial Valuation

Burberry Group, headquartered in London, has established itself as a luxury brand since its founding in 1856. The company generates revenue through various segments including retail, wholesale, and licensing, offering a range of products from apparel to accessories.

Zumiez, based in Lynnwood, Washington, has operated since 1978 as a specialty retailer catering to young adults with a focus on apparel, footwear, and hardgoods such as skateboards and snowboards. The firm has a robust online presence, with multiple e-commerce platforms serving customers across the United States, Canada, Europe, and Australia.

A comparative analysis reveals that Zumiez currently has a consensus price target of $18.00. This figure implies a potential downside of 27.74%. Despite this, analysts suggest that Zumiez has a higher probable upside, making it a more favorable option compared to Burberry Group.

Risk and Profitability Assessment

The risk profiles of the two companies differ significantly. Burberry Group has a beta of 1.14, indicating its stock price is 14% more volatile than the S&P 500. In contrast, Zumiez has a beta of 0.89, suggesting its stock is 11% less volatile than the S&P 500. This difference in volatility can influence investor decisions, particularly those with a lower risk tolerance.

Profitability metrics show that Burberry and Zumiez differ in performance. Burberry Group maintains a strong presence in the luxury market, while Zumiez excels in its niche appeal to younger consumers. Analysts continue to evaluate net margins, return on equity, and return on assets for both companies, providing valuable insights for potential investors.

Institutional ownership also plays a crucial role in assessing the companies’ investment potential. Approximately 10.3% of Burberry Group shares are held by institutional investors, a figure that contrasts sharply with Zumiez, where institutional ownership stands at an impressive 95.5%. Additionally, 21.2% of Zumiez shares are owned by company insiders, indicating confidence from those closely associated with the firm.

In summary, Zumiez outperforms Burberry Group across seven of the twelve factors evaluated in this analysis. While Burberry continues to thrive in the luxury sector, Zumiez’s strong institutional backing and market positioning make it an attractive option for investors seeking growth in the retail sector.

-

Science3 months ago

Science3 months agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

Science3 months ago

Science3 months agoDoctoral Candidate Trivanni Yadav Advances Battery Research at UTulsa

-

Top Stories4 months ago

Top Stories4 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World4 months ago

World4 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

World4 months ago

World4 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

Sports3 months ago

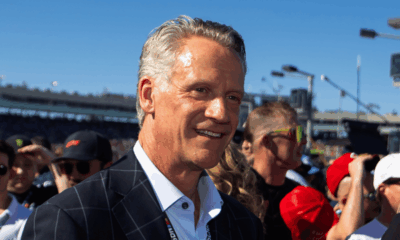

Sports3 months agoNASCAR Faces Fan Backlash as Steve Phelps’ Texts Surface

-

Top Stories4 months ago

Top Stories4 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Business4 months ago

Business4 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Politics4 months ago

Politics4 months agoSEVENTEEN’s Mingyu Faces Backlash Over Alcohol Incident at Concert

-

Science4 months ago

Science4 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Entertainment4 months ago

Entertainment4 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Science4 months ago

Science4 months agoRemembering David E. Brest: A Life Dedicated to Nature and Family