Top Stories

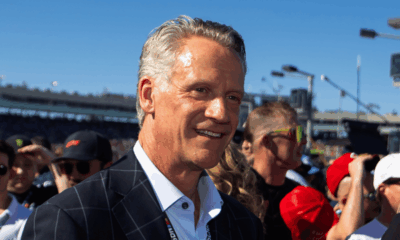

Steve Eisman Dismisses 2008 Crisis Fears Amid Bank Earnings

UPDATE: Investor Steve Eisman, renowned for accurately predicting the 2008 financial crisis, has just dismissed comparisons to that era following a wave of recent bank earnings reports. Speaking on the Real Eisman Playbook podcast on October 14, 2023, Eisman stated the current credit deterioration is “only marginal” and not indicative of an impending recession.

Eisman’s comments come as earnings from major banks like JPMorgan Chase & Co. and Citigroup Inc. revealed mixed trends in commercial credit. He noted, “Yes, there are signs of credit deterioration on the commercial side, but not enough to actually cause a recession or indicate that a recession is about to occur.” This perspective provides a stark contrast to the pre-2008 environment, where “underwriting standards had deteriorated to such an extent that people who should never have been given loans were swimming in them,” Eisman explained.

Recent reports indicate troubling signs within regional banks, however. Zions Bancorporation NA revealed a staggering $50 million charge-off related to commercial loans, leading to a 12% drop in its stock. Similarly, Western Alliance Bancorp faced a decline after announcing a lawsuit against a borrower for fraud.

Adding to the atmosphere of unease, JPMorgan Chase CEO Jamie Dimon warned of rising credit risks during the company’s latest earnings call. He ominously noted, “When you see one cockroach, there’s probably more,” referring to the recent bankruptcies of Tricolor Holdings and First Brands.

Despite these concerns, Eisman remains optimistic about the overall market. He emphasized that the current climate is part of a “normal cycle” rather than harbingers of a financial catastrophe.

As the situation evolves, investors and analysts will be closely watching how these credit quality issues affect regional banks and the broader market landscape. With significant fluctuations anticipated, the focus will remain on upcoming earnings reports and potential corrective measures taken by financial institutions.

For those following the market closely, this news is crucial as it shapes the current financial narrative and influences investment strategies. Stay tuned for further updates as this story develops.

-

Science3 months ago

Science3 months agoALMA Discovers Companion Orbiting Giant Red Star π 1 Gruis

-

Science3 months ago

Science3 months agoDoctoral Candidate Trivanni Yadav Advances Battery Research at UTulsa

-

World4 months ago

World4 months agoGlobal Air Forces Ranked by Annual Defense Budgets in 2025

-

Top Stories4 months ago

Top Stories4 months agoNew ‘Star Trek: Voyager’ Game Demo Released, Players Test Limits

-

World4 months ago

World4 months agoMass Production of F-35 Fighter Jet Drives Down Costs

-

Sports3 months ago

Sports3 months agoNASCAR Faces Fan Backlash as Steve Phelps’ Texts Surface

-

Business4 months ago

Business4 months agoGold Investment Surge: Top Mutual Funds and ETF Alternatives

-

Top Stories4 months ago

Top Stories4 months agoDirecTV to Launch AI-Driven Ads with User Likenesses in 2026

-

Politics4 months ago

Politics4 months agoSEVENTEEN’s Mingyu Faces Backlash Over Alcohol Incident at Concert

-

Science4 months ago

Science4 months agoTime Crystals Revolutionize Quantum Computing Potential

-

Entertainment4 months ago

Entertainment4 months agoFreeport Art Gallery Transforms Waste into Creative Masterpieces

-

Science4 months ago

Science4 months agoRemembering David E. Brest: A Life Dedicated to Nature and Family